Check New Articles

The Comprehensive Guide to Mastering Business Credit for Entrepreneurs

Business credit is a financial system allowing you to purchase goods or services on credit for your business.

Personal Finance

Residential Lending

Financial Planning

Small Business

5Stack | Value

SMB Finance

Dividend Investor

In the dynamic arena of business, credit—often referred to as the lifeblood of operation—holds an intrinsic value. For fledgling startups, well-oiled small ventures, and burgeoning entrepreneurs, understanding and leveraging business credit is fundamental to growth and sustainability. This guide is curated for the proactive entrepreneur who yearns to grasp the intricacies of business credit from the ground up.

Partners

Business Credit Demystified

Business credit is a financial system allowing you to purchase goods or services on credit for your business. It is distinct from personal credit and is based on the payment habits of the business, not the individual. The advantages of building a strong business credit profile are plentiful:

Advantages of Good Credit

- Improved access to working capital

- Competitive rates on loans and insurance

- Establishment of a business identity separate from the owner's personal finances

- Limit personal liability by separating personal and business finances

To harness the benefits, you must undertake a strategic and methodical approach

Establishing Your Business Credit

The Foundation of Establishment

Before you can build upon your business credit, there’s groundwork that needs to be laid. Establishing your business as a separate legal entity is the first crucial step. This involves incorporating your business or forming an LLC (Limited Liability Company), actions that legally distinguish your business from your personal identity. Subsequently, obtaining a federal Employer Identification Number (EIN) from the IRS is necessary, as it acts as a social security number for your business, essential for tax and credit purposes.

Furthermore, setting up a dedicated business bank account and phone line not only legitimizes your operation in the eyes of financial institutions but also facilitates the separation of personal and business finances, a vital practice for protecting personal assets and building a strong business credit profile.

Initial Steps for a Strong Start

1. The very first step in establishing business credit is to separate personal credit from business credit. This includes creating a legal entity for your business, whether it's a corporation or a limited liability company. This separation is crucial in safeguarding your personal assets and building a strong financial base for your company.

2. After laying the foundational groundwork, the next move is to apply for a business credit card. This step is pivotal as it not only aids in further separating your personal expenses from your business expenses but also plays a significant role in building your business's credit history. When selecting a business credit card, consider one that reports to the major credit bureaus. Consistent, on-time payments on this card will help establish your business credit score, an essential metric that lenders, suppliers, and potential business partners will review when evaluating your creditworthiness.

3. Additionally, establishing lines of credit with suppliers and vendors who report to the credit bureaus can be beneficial. This practice assists in building a history of credit transactions, a critical factor in developing a reputable business credit profile. Early in your business's life cycle, not all vendors may extend credit to a new entity without a proven credit history. However, smaller, initial transactions paid on time can help in building trust and pave the way for larger credit lines in the future, contributing positively to your credit score over time.

4. After the business entity is in place, start by obtaining an EIN (Employer Identification Number), followed by opening a business bank account. Consistent positive activity in the bank account, such as a higher average balance, can act as a catalyst for building credit.

5. Next, register your business with credit reporting agencies specifically designed for businesses including Dun & Bradstreet, Experian Business, and Equifax Small Business. These agencies gather information about your business transactions and distill it into a credit report and a score.

Building Credit with Creditors

One way to begin building credit is through trade credit with suppliers who are willing to extend credit to your business. Make sure to ask these suppliers if they report good payment history to the business credit bureaus.

Navigating Business Credit Reporting Companies

Expand Info

Company Bio

For almost 200 years, Dun & Bradstreet has helped clients and partners grow and thrive through the power of data, analytics, and data-driven solutions. Our more than 6,000 employees around the world are dedicated to this unique purpose, and we are guided by important values that make us the establ... Read More

Expand Info

Company Bio

Experian unlocks the power of data to create opportunities for consumers, businesses, and society. We empower consumers and businesses to manage their credit data with confidence so they can maximize every opportunity. Specifically, our business credit reports, credit education resources, and ... Read More

Expand Info

Company Bio

myFICO is the consumer division of FICO, the company that invented the FICO® Score used by 90% of top lenders. Starting in the 1960s, FICO sparked a revolution by pioneering credit risk scoring for the financial services industry. This approach to lending enabled financial institutions to improve th... Read More

1. Dun & Bradstreet (D&B)

Dun & Bradstreet (D&B) plays a pivotal role in the business credit world. To get started with D&B, a business should first apply for a D-U-N-S Number, a unique nine-digit identifier for businesses. This number not only facilitates the process of establishing business credit but also enhances the credibility and visibility of the business in the global marketplace. After obtaining a D-U-N-S Number, it's crucial to ensure your business profile is complete and accurate, as this information is what potential creditors and suppliers will review when making decisions about extending credit or engaging in business transactions with you. Regularly monitoring your D&B credit file can help you understand how your business credit is viewed and allow you to make informed decisions to maintain or improve your credit standing.

D&B is one of the oldest and largest business credit reporting agencies. D&B PAYDEX Score is a key indicator of a business's creditworthiness and their tracking of business payment behavior is pivotal in decision-making processes.

2. Experian Business

Experian Business stands as another essential player in the arena of business credit reporting. This agency offers comprehensive credit analysis and reporting services that enable your business to understand its credit position from a lender's perspective. By presenting a detailed breakdown of your company’s credit obligations and payment history, Experian helps businesses to showcase their creditworthiness to potential lenders and suppliers. Similar to D&B, maintaining up-to-date information with Experian and monitoring your credit report is vital. It allows businesses to pre-emptively address any inaccuracies that may negatively impact their credit score. Engaging with Experian by actively managing your business credit file can pave the way for better credit opportunities and more favorable terms from lenders.

Experian offers a comprehensive business credit report with data sourced from key business credit data furnishers. Their reports can give detailed insights into a company's payment habits and credit history.

3. Block Advisors - H&RBlock

Running a small business is rewarding, but it comes with a fair share of challenges. From managing finances to staying compliant with tax regulations, the to-do list can seem endless. That's where H&R Block Business Services steps in. With decades of experience and a deep understanding of the unique needs of small businesses, H&R Block offers comprehensive solutions that can streamline operations and drive success.

Block Advisors provides Audit Support, Business Formation, Tax Preparation and Tax Planning services for Small Businesses

4. myFICO - Small Businesses

MyFICO is a valuable resource for small businesses looking to improve their credit score and credit management. MyFICO offers personalized advice and tools to help you understand your credit standing, identify areas for improvement, and make informed decisions for your business.

Their services include credit monitoring, score tracking, and education on how to build and maintain a strong credit profile.

5. Equifax - Small Business

Equifax Small Business, like its counterparts, is a vital entity in the landscape of business credit reporting. It provides an extensive range of services designed to offer a deep dive into a company's credit performance. By leveraging Equifax's detailed reports, businesses can gain a clearer understanding of their credit status, which is crucial for securing financing and establishing trust with potential partners. Equifax's commitment to accuracy helps ensure that the information presented is reliable, enabling business owners to make informed decisions based on their credit data. Regular engagement with and monitoring of one's Equifax credit file can uncover opportunities to improve creditworthiness and identify potential issues before they escalate, thereby safeguarding the financial health of the business.

Equifax provides a Small Business Credit Risk Score which is a cumulative view of the risk of business default-based on a variety of financial factors.

The ABCs of Applying for Business Credit

Knowing When to Apply

Understanding the right time to apply for business credit is just as crucial as the application itself. A business should apply for credit when it has a good chance of being approved and when it can be easily managed. This means applying once the business has firmly established a payment history and when it has a good understanding of what its credit reports and scores look like.

Preparing the Necessary Documentation

Before applying for business credit, it's essential to gather and prepare all necessary documentation. This typically includes business financial statements, tax returns, business plans, and a detailed account of how the credit will be used. Additionally, lenders may request information about the company's ownership structure, revenue projections, and existing debts. Having these documents well-prepared and organized can significantly streamline the application process, making it easier for lenders to assess the creditworthiness of the business swiftly. Preparing thoroughly demonstrates professionalism and readiness, which can positively influence the decision-making process of potential creditors.

The Application Process

Be prepared to provide the following when applying for business credit:

- Business's legal name and contact information

- Trade references and banking information

- Financial statements, if requested

Strategically Managing Credit Utilization

Properly managing credit utilization plays a pivotal role in maintaining a healthy business credit profile. Credit utilization is the ratio of your current outstanding credit balances to your available credit limits. A lower credit utilization ratio is generally seen as positive by lenders, as it suggests that the business is not overly reliant on credit and manages its debts responsibly. Experts recommend keeping the credit utilization ratio under 30% to avoid negatively impacting your credit scores. Monitoring and adjusting your credit utilization can ensure that your business remains attractive to lenders, potentially leading to more favorable borrowing terms in the future.

We work with an extensive network of lenders, financial institutions, credit bureaus, commercial brokers, fintech companies to provide an array of options tailored to your business success.

$350,000

SBA Express Loan

for Hair Salon

$1.2 Million

Business Acquisition

for Veterinarian

$150,000

Equipment Finance

for Machine Shop

$400,000

Commercial Real Estate Office Loan

for Professiona Practice

Responsibly Managing Business Credit

Paying on time is one of the most influential factors in your business credit score. Late payments can have a significant negative impact on your creditworthiness and, consequently, your ability to secure favorable financing terms.

In conclusion, the terrain of business credit is one that demands proactive management, sound strategy, and a forward-thinking mindset. By establishing robust credit practices with diligent record-keeping, the potential for growth and financial agility amplifies. Small business owners and entrepreneurs should approach business credit with the same level of attention and importance as any other operational facet, valuing it as a vehicle for long-term success.

Partners

Articles Section

- Personal Finance Articles

- Residential Lending Articles

- Financial Planning Articles

- Small Business Articles

- Dividends Articles

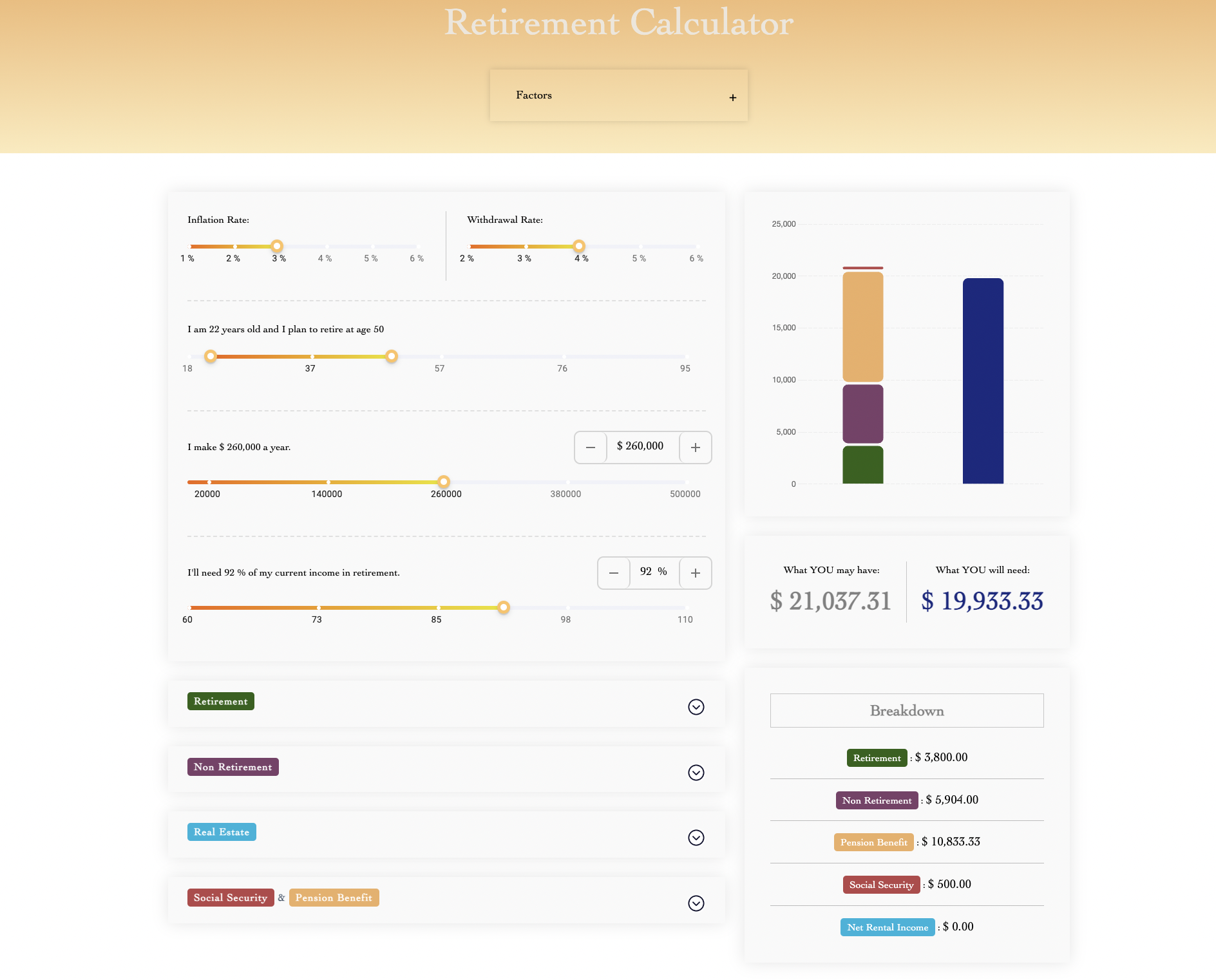

SIMPLIFYING CALCULATION

SIMPLIFYING CALCULATION